Egan Explains: Is Bankruptcy Right for You?

In 2023, annual bankruptcy filings rose a staggering 29.9%, jumping from 383,810 filings in 2022 to 433,658 the following year. Interest rates are rising. The job market is tough. Today, no matter where you live in the country, it’s just generally more expensive and difficult to get by. Filing for bankruptcy may not be the option you thought it was. While it has a harsh connotation, filing for bankruptcy can help Americans get back on track and take control of their debt. In some cases, it can give people a much-needed fresh start.

In New Mexico, there are approximately 53.66 personal bankruptcy filings per 100,000 residents. Which means, there are many New Mexican residents who need to know what their options are and which route is the best for them and even their families.

Here are a few things you need to know about personal, or Chapter 7, bankruptcy:

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is a form of bankruptcy that allows you to discharge most of your unsecured debts, providing a fresh start free from the burden of debts you can no longer afford. This process involves the liquidation of your non-exempt assets by a trustee, who then distributes the proceeds to your creditors.

To qualify for Chapter 7 in New Mexico, you must pass a means test, which compares your income to the median income for a household of your size in the state. If your income is below the median, you may file for Chapter 7. This chapter is particularly effective at wiping out debt from credit cards, medical bills, and other unsecured debts.

What Can Bankruptcy Do For Me?

Filing for bankruptcy can offer immediate financial relief as well as long-term benefits. As soon as you file, the court will issue an automatic stay which stops most creditors from pursuing debt collection activities, including calls, letters, and wage garnishments. This can provide immense emotional and financial relief to those feeling the constant stress of creditor actions.

The primary benefit of Chapter 7 is the discharge of debts. It allows debtors to eliminate the legal obligation to pay most or all of their debts, offering a clean slate and the opportunity to rebuild their financial life.

Is Chapter 7 Bankruptcy Right for Me?

While Chapter 7 can provide significant relief, it is not suitable for everyone. This form of bankruptcy is best suited for individuals who:

- Do not have a significant amount of assets that would be at risk of liquidation.

- Have a lot of unsecured debt that they are unable to repay.

However, it’s important to consider the impacts on your credit score, as a bankruptcy can remain on your credit report for up to 10 years, affecting your ability to obtain new credit.

What Will Happen After I File for Bankruptcy?

Once you file for Chapter 7 bankruptcy, you will need to attend a meeting of creditors, also known as a 341 meeting, where creditors can ask you questions about your finances and the bankruptcy forms you’ve filed. The whole process, from filing to discharge, typically takes about three to six months.

After your debts are discharged, you are no longer legally required to pay them, but the bankruptcy will impact your credit and can influence your ability to secure loans or credit at favorable rates. However, many find that with careful planning and responsible financial management, they can begin to rebuild their credit over time.

Will Bankruptcy Affect My Credit?

Yes, filing for bankruptcy will impact your credit. Chapter 7 bankruptcy can remain on your credit report for up to 10 years from the filing date. The immediate effect is typically a significant decrease in your credit score. This happens because bankruptcy signals to creditors that you have defaulted on many of your financial obligations.

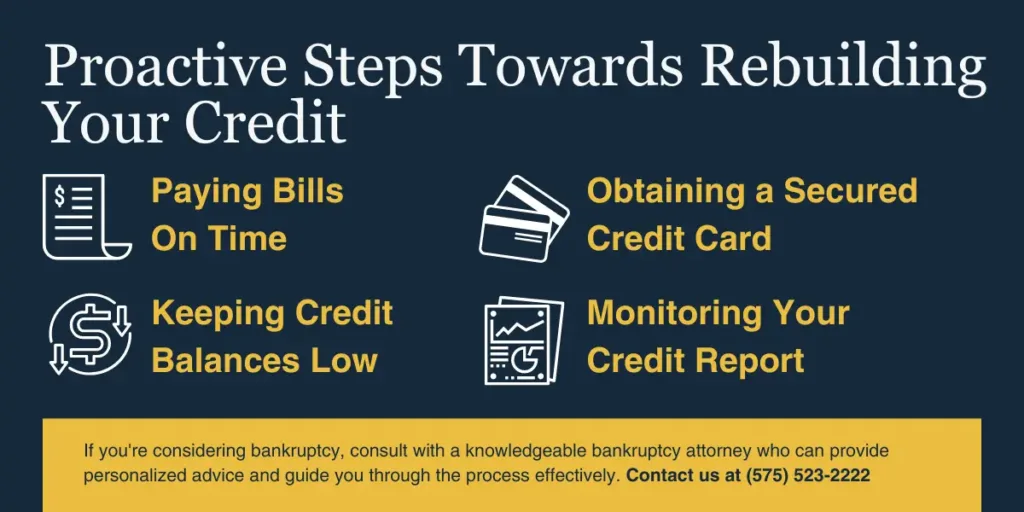

However, the impact of bankruptcy on your credit is not permanent. Over time, the negative effect diminishes, especially if you take proactive steps towards rebuilding your credit. These steps can include:

- Paying bills on time: Post-bankruptcy, it’s crucial to ensure that all your bills are paid on time. This positive payment history will help to gradually improve your credit score.

- Obtaining a secured credit card: A secured credit card, where you deposit money upfront as a security, can be a good way to start rebuilding your credit. It demonstrates to lenders that you can manage credit responsibly.

- Keeping credit balances low: Try to use a small portion of your available credit. High credit utilization can negatively affect your score.

- Monitoring your credit report: Check your credit report regularly for inaccuracies that might be hurting your score. If you find errors, dispute them with the credit bureau.

Although bankruptcy carries significant initial drawbacks for your credit score, many individuals find that filing for bankruptcy ultimately helps them regain financial stability faster than struggling indefinitely with unmanageable debt. By resetting your financial situation, you can start afresh and rebuild a stronger financial foundation.

Finding a Las Cruces Bankruptcy Attorney

Chapter 7 bankruptcy offers a way out for many who find themselves unable to cope with overwhelming debt. It is a tool that, when used correctly, can drastically improve your financial situation and provide a second chance at economic stability.

If you’re considering bankruptcy and live in Las Cruces, NM, it’s important to consult with a knowledgeable bankruptcy attorney who can provide personalized advice and guide you through the process effectively.

At The Law Offices of Kenneth G. Egan, we’ve been helping Las Cruces residents take control of their financial situation through Chapter 7 bankruptcy for years. If you are considering this route, reach out to us or give us a call at (575) 523-2222 for a free, no obligation consultation, and let us guide you through this stressful time.